The Trump administration’s relentless attack on the Federal Reserve is the symptom of a deeper desperation: of an administration rapidly running out of options to manage the country’s gargantuan and growing debt pile. (Currently at $37T)

The DOGE dissolution earlier this year was a critical moment.

It proved conclusively that those ‘third rails’ of fiscal policy — raising taxes and cutting entitlement spending — cannot be touched.

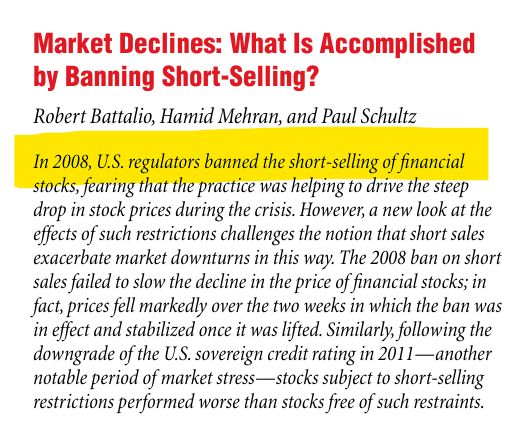

Attacking the Fed, Tariffs, and ad-hoc interventions into Corporate America (like the Intel stake and the revenue share with NVDIA and AMD) are anyway piecemeal approaches and do not really address the scale of the problem.

(What do you make of the fact that, the country, with unarguably the most powerful military on the planet, already spends more on interest payments to service debt than on Defence?)

All three approaches are marginal tools, not an outcome focused strategy. They merely chip at the edges of a towering pile of debt.

So, what then could be a more serious, effective option?

Think about it.

When households are in a similar situation, saddled with a truckload of debt and if the interest payments really start to crowd out all other spends, what would you do?

You would do the ONE thing that can truly alter the situation meaningfully.

Asset Sales.

The US government is one of the world’s largest landowners and asset holders, with over 640 million acres (that about 30% of total land acres), vast energy rights, infrastructure, and IP.

Asset sales or Asset Recycling initiatives isn’t without a precedent.

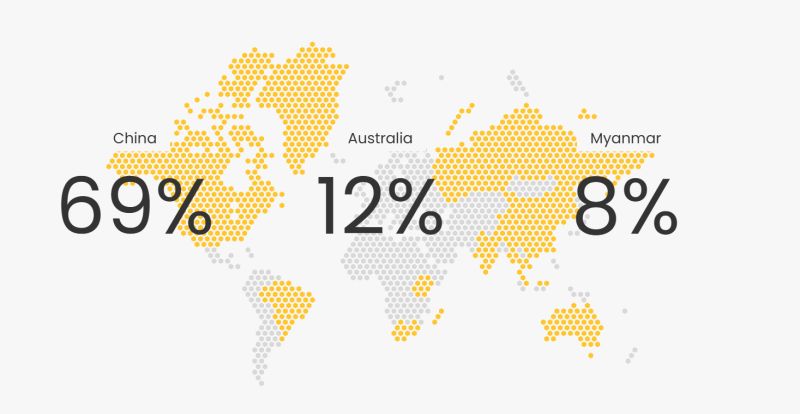

Facing similar political constraints, Australia incentivized its states to sell mature, public assets (like ports and power networks) and used the proceeds to fund new, productivity-boosting infrastructure.

The federal government contributed 15% of the funding for new projects, creating a powerful ‘two-fer’: unlocking investment for the future while recycling capital from the past.

The logic is compelling:

✅ Politically palatable: Easier for voters to buy-in than cuts to entitlements or tax hikes.

✅ Fiscally pragmatic: Generates a massive, one-time revenue infusion to pay down debt.

✅ Forward looking: Can be designed, as in Australia, to fund critical new investment in national infrastructure.

So, while the US has never done this before; asset sales, may soon move from the fringe to the center of the debt debate.

It appears inevitable.

Granted, governments, unlike households, get to binge on potentially infinite debt.

But there are finite limits to interest payments. (Assuming that we do not descend into the Kafkaesque zero or negative rate world! 😀)

And when you can’t raise revenue or cut spending to service those rising interest payments, you will eventually — whether you are a government or household — have to look at your balance sheet.

And establish a pecking order for the sale of your assets.