Now that we are past Jackson Hole, expect a sharp pickup in Fed-watching: from now until the next black out window (Sep 6-15).

Thanks to the prevalence of social media, there is no getting away from the barrage of FOMC-related newsfeeds.

This post isn’t about that.

It is about Authority Bias — our tendency to be influenced by people in positions of authority.

We must be wary of this.

To be clear, this post isn’t really about being dismissive of 5-year frameworks; it’s about not anchoring heavily into them.

Blunders have happened in the past and will continue to happen.

Here is an episode from the yesteryears to illustrate my point:

On Sept 26, 1999, a group of European central banks made a historic blunder.

They signed the first Central Bank Gold Agreement (CBGA).

The context?

Gold was languishing at $250/oz. The prevailing wisdom then was that gold was a ‘barbarous relic,’ an archaic asset that offered no yield.

Central banks, holding thousands of tonnes of it, were eager to sell gold for coupon generating govt bonds.

The problem?

Uncoordinated sales risked flooding the market and crashing the price further, hurting their own balance sheets.

The solution?

The CBGA.

Its ‘genius’ was to create a cartel of central banks not to prop up the price, but to manage its decline. They agreed to cap collective sales to 400 tonnes/yr for 5 years, providing ‘predictability’ to the market. In reality, it was a coordinated effort to offload an asset they believed was headed for obsolescence.

They succeeded in selling.

But the story didn’t end there.

The CBGA was renewed thrice (2004, 2009, 2014), continuing the managed sell-down. For over a decade, Western central banks were steady sellers.

They were selling into what became the greatest bull market in modern gold history.

The very act of capping sales reassured the market that a glut wasn’t coming. It provided a floor, and as other factors emerged — the rise of gold ETFs, and later, the GFC and the unprecedented QE — gold began its epic climb.

The irony is breathtaking.

The agreement designed to manage the orderly disposal of gold ultimately helped create the stability that allowed its price to soar.

Fast forward to the fourth and final agreement (2019). The tone had completely changed — gold remained an important reserve asset.

Why the change?

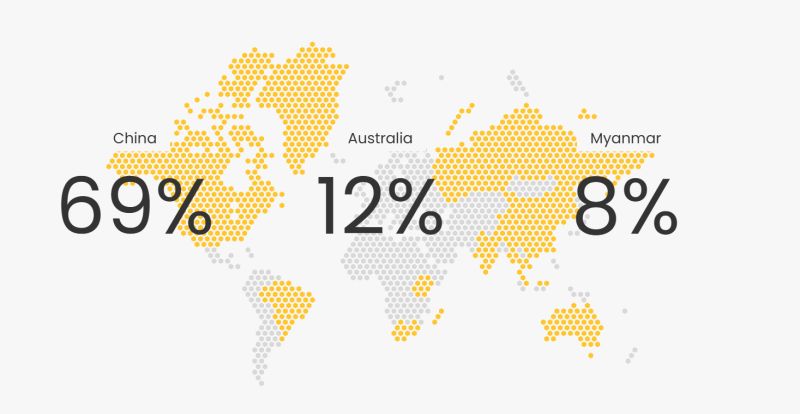

Because by 2019, the buyers were no longer private investors; they were the central banks of the East — Russia and China primarily — who saw gold’s strategic value as a USD-diversifier.

They were buying what the West was selling.

The CBGA signatories had executed the ultimate trading faux pas on a grand scale:

They sold low and, by ceasing their sales as the price rallied, ultimately bought high later.

The CBGA is a stark reminder that even Central Bank consensus is not always a signal of correctness; it could instead be peak groupthink.

So, keep your newsfeeds open.

And your anchors lightweight.