Surely you have a favourite misnomer of your own.

You know, a name or a label that sounds wrong?

Like Greenland (which is mostly covered in ice) and Iceland (which is mostly green).

Or a Koala Bear (which is not a bear but in fact a marsupial).

But few misnomers carry as much geopolitical weight today as ‘Rare Earth’.

That is ONE. SOLID. MISNOMER.

The 17 metals that constitute Rare Earth are not actually rare; they are in fact relatively abundant in the Earth’s crust (some of them more than Gold, some more than Copper).

The true challenge, and the heart of the current standoff between China and the US, is not in locating them or owning them – it is in refining them (as Elon Musk so emphatically stated earlier this year).

The process of turning ore into usable, high-purity rare earth is complex, environmentally hazardous (and that is precisely where the shift to China occurred a few decades ago!), and incredibly expensive (if you are not operating at a massive scale).

And since then, China has strategically built an unassailable lead on this very capability. This dominance allows them to control the market for products made from Rare Earth (Think here of: Permanent Magnets, Batteries, Electromobility, Aviation).

Which brings us to the current high-stakes drama.

Talks over the weekend have reportedly yielded a temporary reprieve: a reported one-year postponement of China’s new rare-earth export restrictions, seemingly in exchange for the U.S. holding off on planned 100% tariffs. (I say ‘reported’ twice in a paragraph because China has not yet categorically confirmed the postponement)

Even if China does confirm this [postponement] later this week after the Trump-Xi meeting at the APEC summit, one thing is clear:

A one-year extension is not a win. It is a telling sign of how much leverage China holds over the US and the Rest of the World on Rare Earths.

All this underscores two uncomfortable truths for the U.S. and its allies:

1. Despite having rare earth deposits domestically, the US will continue to remain critically dependent on China’s rare earth products.

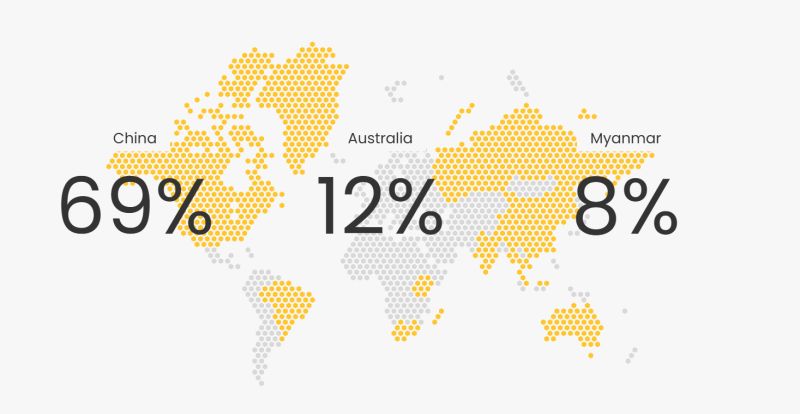

2. China’s dominance is not just about its own mines. It is about a well-tuned supply chain that now includes countries like Myanmar and Laos (See image for Largest Producers of Rare Earth Products for 2024; source www.rareearths.com)

Rest assured the aftermath of the Trump-Xi meeting at the APEC summit might well have the usual trappings of yet another ‘epic victory’ for the Trump administration, but the core point wouldn’t have budged an inch:

China continues to maintain a chokehold on all finished products from rare earths.